What are the best places to buy rental property in California?

You’ve come to the right place.

Today, you’ll learn how to find affordable investments with the best return despite California’s high prices and strict regulation.

I’ve personally invested in several properties in California, and my portfolio is worth seven figures.

Want to learn how I did it? Read on!

Key takeaways:

- Best ROI: For the best balance of affordability and returns in California, target inland cities like Sacramento, San Bernardino, and Fresno – they offer median property prices under $500K while maintaining healthy rental rates ($1,700-$2,000), steady job growth (0.8-2%), and vacancy rates below 6%.

- Best investments: College towns consistently make strong rental markets – cities like San Bernardino, Sacramento, and Fresno all have major universities and appear in the top 10. (Read on to understand how you can use this to increase your property cash flow!)

What are the best places to buy a rental property in California?

California’s rental market and rents are increasing. For example, rents will increase by 2% to 3.5% yearly in Southern California over the next two years.

This is one of the reasons California is a great place to invest in rental property.

Take myself, for example. I’m based in California and I started building my property portfolio here. In fact, I’ve retired from my pharmacy job thanks to my investments!

Here I am in front of one of my California properties.

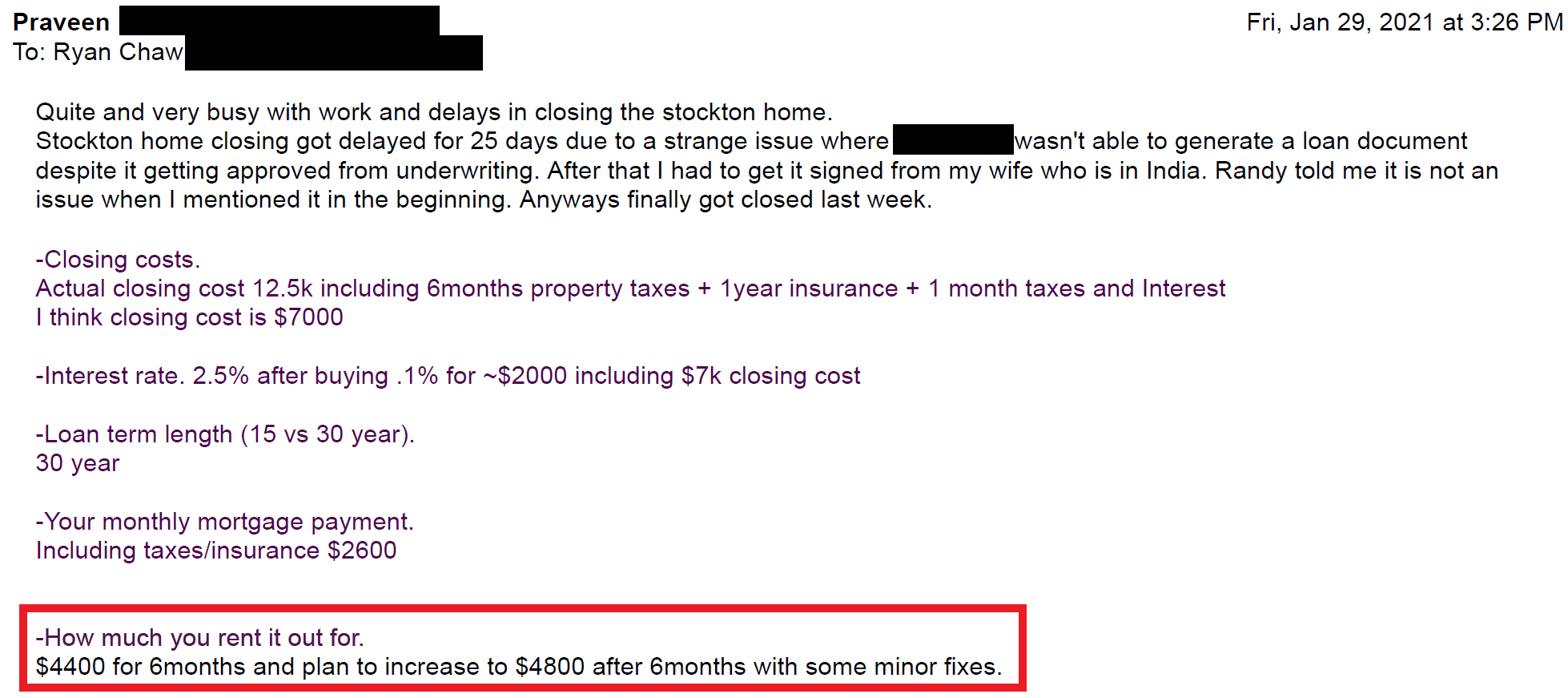

Similarly, many of my consulting clients are based in California and they’ve invested in some highly profitable properties.

Take Praveen – his California investment property in Stockton has a $1,000 cash flow.

That said, finding a rental property in California can be difficult because of the high property prices and regulation.

Well, I took a look at market data and came up with this list of the best places to buy a rental property in California are:

- Santa Clarita

- Pomona

- Anaheim

- Palm Springs

- San Bernardino

- Burbank

- Riverside

- Hawthorne

- Sacramento

- Fresno

First, though, what should you look for in a location for your first rental property?

What to look for in a California rental property

A few factors to consider include:

- Average property values: To ensure good cash flow, your rental income needs to cover your mortgage and then some.

- Rental demand: Luckily, the demand for rental properties is increasing in California overall. But each area has fluctuating rental rates depending on jobs and students. An increase in job growth in the area usually correlates with higher rental demand.

- Median household income: Investing in an area with a medium-high median household income means you can charge higher rent, which means more profit for your business.

- Rental rates: This shows you the average rent cost, helping you set competitive rates. Keep in mind you can get a better ROI by investing in areas with high rent.

- Vacancy rates: With this, you’ll see how many vacant properties there are in the state.

- Rental property regulations: Every state is different when it comes to these, including things like rent pricing and eviction laws. Keep in mind that stricter doesn’t always mean worse, though. Sometimes, this means better protection for you.

I use these factors to determine my rental properties. With them, I’ve built a seven-figure portfolio with properties all over the United States.

And over the years, I’ve learned how to spot great opportunities. To help you get started, I used the following sources to put together this list:

- Median property list price: Zillow

- Average rental rate: RentCafe

- Vacancy rate: GuaranteedRate

- Median yearly household income: Data USA

- Cost of living index: Best Places

- Population: United States Census Bureau

So, where should you buy rental property in California?

Read on.

1. Santa Clarita

Santa Clarita is one of the best places to buy rental property in California. The city is known for being family-friendly with top schools and safe neighborhoods. This makes it a great place for landlords to invest in residential rental properties.

Plus, the median household income is one of the highest in the state, meaning you can charge higher rents. The only downside is there’s slow population growth because housing is expensive.

Median property list price: $763,333

Average rental rate: $2,456

Vacancy rate: 2.9

Median yearly household income: $116,186

Cost of living index: 164

Population: 228,673

Job growth: 0.7%

Median property list price: $800,000

Average rental rate: $2,456

Vacancy rate: 2.9

Median yearly household income: $116,186

Cost of living index: 164

Population: 228,673

Job growth: 0.7%

2. Pomona

Pomona is a great place for reasonable house prices and long-term renters. It’s a bustling area in Los Angeles County that attracts families and young professionals. With a slow population and job growth, don’t expect a lot of new tenants. Instead, build a great portfolio with rolling rental contracts with single-family properties.

Median property list price: $639,667

Average rental rate: $2,154

Vacancy rate: 1.5%

Median yearly household income: $73,515

Cost of living index: 161.7

Population: 151,713

Median property list price: $660,000

Average rental rate: $2,137

Vacancy rate: 1.5%

Median yearly household income: $73,515

Cost of living index: 139

Population: 151,713

Job growth: 0.7%

3. Anaheim

Anaheim is famous for being the home of Disney World. Because of the theme park’s success, it’s had huge population growth. There are also more job opportunities for young professionals.

The median household income is very high, leading to higher average rent prices. The only drawback is the average house price is much higher than in other cities. So, you’ll need a lot of funding to afford your first property there.

If you have low funding to start your real estate business, don’t worry. This video will give you some more ideas:

Median property list price: $874,833

Average rental rate: $2,368

Vacancy rate: 3.3%

Median yearly household income: $88,538

Cost of living index: 164.9

Population: 346,824

Median property list price: $914,289

Average rental rate: $2,368

Vacancy rate: 3.3%

Median yearly household income: $88,538

Cost of living index: 162

Population: 346,824

Job growth: 0.6%

4. Palm Springs

Considering the popularity of Palm Springs, the property prices are relatively low. On top of that, the area has steady job growth, leading to more young professionals relocating there. With a great climate all year round, you can see why it’s a great draw for people wanting to settle in California.

That said, competition for housing is high. So, now is the best time if you want to get into this market.

Median property list price: $656,667

Average rental rate: $2,042

Vacancy rate: 9.9%

Median yearly household income: $67,451

Cost of living index: 131.2

Population: 45,575

Median property list price: $829,000

Average rental rate: $2,042

Vacancy rate: 9.9%

Median yearly household income: $61,597

Cost of living index: 131

Population: 45,575

Job growth: 2.2%

5. San Bernardino

San Bernardino provides new landlords with low property prices and a high ROI. It’s particularly popular for college students attending California State University, San Bernardino.

The downside is that the rental rate is comparatively low for the state. But multi-family or student housing can increase your profits.

Median property list price: $456,333

Average rental rate: $1,761

Vacancy rate: 6%

Median yearly household income: $61,323

Cost of living index: 118.6

Population: 222,101

Median property list price: $475,000

Average rental rate: $1,761

Vacancy rate: 6%

Median yearly household income: $61,323

Cost of living index: 118

Population: 220,068 (San Bernardino City)

Job growth: 0.8%

6. Burbank

Located in Los Angeles County, Burbank is an excellent place to live. It has an airport, multiple sports stadiums, and it’s close to Hollywood. This all attracts high-earning young professionals.

For that reason, the house prices are sky high, meaning more people rent in this area than buy. However, if you can get the right mortgage, your property will appreciate, and you’ll make a comfortable return on investment.

Median property list price: $1,186,417

Average rental rate: $2,727

Vacancy rate: 1.4%

Median yearly household income: $91,455

Cost of living index: 161.7

Population: 102,755

Median property list price: $1,100,000

Average rental rate: $2,700

Vacancy rate: 1.4%

Median yearly household income: $82,246

Cost of living index: 187

Population: 102,755

Job growth: 0.7%

7. Riverside

If you want to get into commercial real estate, Riverside is a great candidate. Many businesses wanting to operate in Los Angeles choose Riverside because of the affordable rent and great location.

There are student housing opportunities around UC Riverside too, which adds to the vibrant young community there.

Median property list price: $625,500

Average rental rate: $2,161

Vacancy rate: 5.8%

Median yearly household income: $83,448

Cost of living index: 131.2

Population: 318,858

Median property list price: $635,000

Average rental rate: $2,161

Vacancy rate: 5.8%

Median yearly household income: $78,727

Cost of living index: 131

Population: 320,785 (Riverside City)

Job growth: 2.2%

8. Hawthorne

Hawthorne is an up-and-coming area in LA County that is worth exploring. House prices are quite high, but it has a diverse market of families, young professionals, and commercial renters.

There are multiple tech and aerospace companies in the area that drive steady population and job growth year over year. That means you’ll have a consistent demand for housing as a landlord and a better ROI in the long run.

Median property list price: $929,333

Average rental rate: $1,820

Vacancy rate: 2.6%

Median yearly household income: $72,298

Cost of living index: 161.7

Population: 88,083

Median property list price: $949,000

Average rental rate: $2,200

Vacancy rate: 2.6%

Median yearly household income: $72,298

Cost of living index: 149

Population: 88,083

Job growth: 0.7%

9. Sacramento

The biggest benefit Sacramento offers a newbie real estate investor is low property prices. In fact, you’ll find some of the lowest property prices in the state here. Also, because of its California State University campus, it’s a great place for renting to students.

I recommend Rosemont, Tahoe Park, Midtown, and Land Park as potential neighborhoods to buy. The rental rates are lower than the rest of the state, but you can maximize profits with a multi-family or student property.

Median property list price: $437,833

Average rental rate: $1,850

Vacancy rate: 5%

Median yearly household income: $78,954

Cost of living index: 127.2

Population: 524,943

Median property list price: $499,000

Average rental rate: $1,990

Vacancy rate: 5%

Median yearly household income: $78,954

Cost of living index: 127

Population: 524,943

Job growth: 1.4%

10. Fresno

Finally, if you want low vacancy rates, low property prices, and steady demand, Fresno is a great choice.

Fresno has a California State University campus too if you want to get into student real estate investing.

Median property list price: $365,140

Average rental rate: $1,559

Vacancy rate: 4.5%

Median yearly household income: $63,001

Cost of living index: 103.7

Population: 542,107

Job growth: 2%

Median property list price: $407,500

Average rental rate: $1,395

Vacancy rate: 4.5%

Median yearly household income: $63,000

Cost of living index: 103

Population: 545,567

Job growth: 2%

Is California a good place to buy an investment property?

If you’re wondering if California is worth it for rental property, the answer is yes!

Here’s why:

- High demand: California is one of the most popular places in the country to live. With over 38 million residents, there are more people in California than any other state.

- Potential for appreciation: The average appreciation rate for homes purchased in California is between 44.77% and 100.97%. So, when you’re ready to sell your property, you’ll make a great return.

- Diverse markets: Students, young professionals, and families are all rental candidates in California. This is especially true in Southern California hotspots like Sacramento and Riverside.

- Low property taxes: With a property tax rate of 0.81%, California has one of the lowest property tax rates in the country.

- Rise in renters and rental prices: Did you know that California has the second-highest percentage of renters in the country? The cost of rent has also steadily increased in California over the years which means you can maximize profits as a landlord. That said, always check the latest state laws.

Also, while the list here above is a great starting point, there are far more profitable locations you might want to research.

For example, a few interesting locations are…

- Loma Linda

- Merced

- Modesto

- Stockton

- Vallejo

I and my clients have found investment properties in places like Stockton, Fulton, and San Jose, so there are plenty of opportunities in California.

Not to mention that I live rent free in California thanks to my investments. Here’s how:

Next, let’s take a look at what types of properties are most profitable.

What rental properties make the most money?

Now you know why California is a great place to invest, but what is the most profitable type of rental property?

Here are four:

- Residential: If you choose the right neighborhood, residential property can give you a great long-term return on your investment.

- Commercial: Commercial real estate is a wide niche, including retail, office, and industrial facilities.

- Multi-family: If you purchase a property with several rental units, it’s categorized as multi-family housing. This can range from a few units to hundreds.

- Single-family: Single-family means that the property consists of just one dwelling unit.

My favorite? I buy mostly single-family units that I rent by the room to college students. California is a great place for this type of investing, given how many good universities there are in this state.

FAQ: Investment properties in California

Is California still a good place to invest in real estate?

Where are the best places to buy investment property in Southern California?

Some of the best areas include Riverside, San Bernardino, and Santa Clarita due to their growing populations and relatively affordable prices. Consider neighborhoods with high rental demand and steady appreciation.

How many rental properties to make $5000 a month?

What are the best places to buy rental property in the USA?

Cities like Austin, Texas, Tampa, Florida, and Raleigh, North Carolina, are excellent due to their strong job markets, population growth, and landlord-friendly policies. However, research specific markets for high demand and cash flow potential and, as a new investor, invest in properties close to where you live.

Want to find your first rental property?

That’s it! Those are the best places to buy rental property in California. But if you want to start a successful real estate investment business and leave your day job, there is much more to learn.

Want help?

I was a total newbie when I started real estate investing. Since then, I’ve built a seven-figure portfolio and retired from my day job as a pharmacist.

I’d love to help you get similar results!

So, if you’re ready to invest in your first property, find out more about my one-on-one real estate coaching here.

Read more:

The Best (and Worst) States to Buy Rental Property

How to Buy a Rental Property as a Complete Beginner

The Average Cash Flow for Rental Properties

This blog post is for informational purposes only and does not constitute investment advice.